Last month, Digital and Culture Secretary, Oliver Dowden, placed the UK’s tech sector at the core of the UK’s recovery from Coronavirus. At the same time, he announced that Government will launch a new digital strategy in Autumn, focusing largely on the adoption of digital skills and business transformation through tech.

Despite a turbulent few month across the entire business landscape, the tech sector is still buoyant, with the UK outperforming the rest of Europe for tech investment in 2020. Yes, many of the deals pushed through will have likely been agreed ahead of the virus, but you only need to look at the news to see that there are still new deals happening every day.

Demand for designers and developers

While employment in general is massively down, the UK saw a spike in IT job postings in July, with demand for designers and developers jumping 15% on June’s figures – in part due to the inadvertent digital transformation most of the UK’s workforce and businesses has undergone in recent weeks. With other industries such as hospitality and travel suffering massively, the tech sector is looking like a much safer bet moving forward.

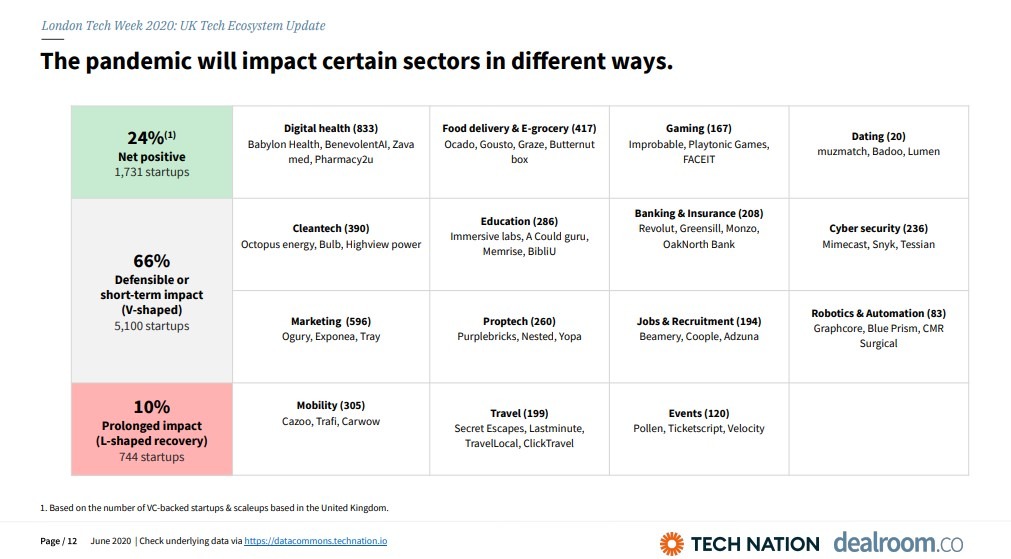

With so many sub-sectors, some parts of the tech industry are inevitably faring better than others. Tech Nation has provided some useful data (below) looking at how various different tech verticals that are being impacted by the pandemic. Unsurprisingly, sectors such as digital health and food delivery have seen a positive impact, while travel and events tech businesses are expecting to face a very difficult recovery period.

Quick bounce back for FinTech

Aside from the obvious subsectors of tech that are thriving, we also expect to see FinTech bounce back – albeit with the bigger players first. While the above figures show the banking and insurance sector to be reporting a short-term impact, it’s a sector that’s likely to pick back up again.

You just need to look at the sheer amount of investment being pumped into UK FinTech by investors – 39% of VC funding in London by sector 2020 to date was into FinTech firms. This is in addition to a number of serious M&As in the sector which have taken place over just the past few weeks.

Despite these positive signs, we know that many smaller FinTechs are struggling to make ends meet, with many facing huge funding gaps and cashflow issues. This is a huge issue, which many organisations and trade bodies are currently lobbying for support on. After all, it’s often the smaller players that really lead on innovation in the sector, so it’s a problem that needs tackling. We don’t want to lose those innovative start-ups at any cost.

Just this week, the Government launched its independent review of the FinTech sector to identify growth areas and look at how the UK can cement its place as a worldwide FinTech leader. We’re hoping that this will place as much focus on the smaller players as it does the bigger ones – proving we need proper support for both in order for the ecosystem to function properly.

So what does this mean?

Working with companies across the breath of the tech sector, we can’t help but keep an optimistic view. So, we thought it was pertinent to end this post by mentioning the fact that the last recession birthed a number of what are now some of the biggest tech companies in the world – Zoopla, AirBnB and Uber, to name just a few. We won’t sugar coat it; it’s going to be a very difficult few months for businesses, but the Refresh stance is always to look for the opportunities in crisis – of which there are many. Particularly in the buoyant tech sector.