Last week, Whitecap Consulting released its report into the state of the Fintech sector in Manchester and the results are very positive. The report comes as no surprise to the team at Refresh; we live and breathe Fintech every day and can see the rapid growth the industry is currently going through in the city. It’s an exciting time for us all.

Manchester is the UK’s largest Fintech hub outside of London and has the highest proportion of scaleups in the whole of the UK. Not only this, but an estimated 10,000 people work in Fintech related roles in the city.

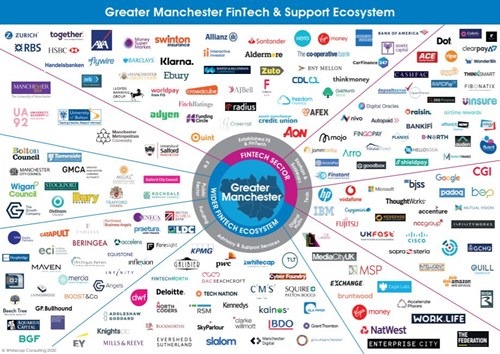

But, it’s not just your traditional financial institutions which are making Manchester’s Fintech ecosystem thrive, it’s the support services, public sector, funding bodies, advisory groups, and digital hubs which our city is known for that are ensuring our ecosystem flourishes.

Why Manchester?

With more eCommerce unicorns in Manchester than any other city in Europe (5), there’s surely something in the water here in the city which is helping to lead these Fintech firms to success and why well-established Fintech institutions, like Klarna and Amazon Web Services, are setting-up shop here.

This may be due to the advanced support network that resides in the city or the independent bodies working to promote, represent, connect, and address any issues which may be faced by the industry in Manchester. Organisations supporting the Fintech ecosystem include: MIDAS, Manchester Digital, KPMG, Eagle Labs, and GC Angels. So, whether it’s help with investment, setting up an office in Manchester, getting your foot in the door here, or just learning about our growing tech hub – Manchester’s support businesses are here to help.

How can we enhance the Fintech sector in the city?

But, despite growth, Manchester still suffers from brain-drain (when highly skilled people move away from the region) and a lack of funding in comparison to the Capital. Although over half of graduates from Manchester’s universities stay in the region, the compelling nature of London’s financial services scene means it attracts the major pool all finance graduates.

When it comes to funding in the city, Manchester has a significant cluster of private equity firms and is the highest-ranking northern city for investment activity. But there is a shortage of early stage funding for Fintech start-ups and this is partly a result of a reluctance of investors to provide funding into sectors or regions they are not familiar with – hence why London sees the majority of these investments.

The city has huge potential but if we don’t address the current issues which impact the region’s growth we could end up at a stalemate and see our financial service institutions and talent pool migrate elsewhere.

There’s no doubt that the region would benefit from a catalyst to inject energy and pace into the city’s current Fintech offering but, what exactly this catalyst is and how it should be implemented is still not confirmed. In Whitecap Consultancy’s report, there were several factors which respondents claimed should be integrated to support this catalyst. These were education, transport, business support systems, facilitated co-operation between establish and start-up financial institutes, more focused events, and promotion of the industry. Therefore, there’s still work that needs to be done by the ecosystem as a whole to establish where best to place our efforts as a city in order to make these operations a success.

Additionally, when looking at the news medium for Fintech-related press, and mentions of Manchester, it was discovered that the region follows the overall UK Fintech trends, except for the fact talent was mentioned more frequently and the percentage of mentions for the term financial services was lower than that of the UK as a whole. But, mentions of University was 3% higher than the UK average, showing education’s role in Manchester’s Fintech sector. Therefore, there’s key elements which must be mentioned in media relations going forward to ensure the region is getting the noise it really needs. There should be an emphasis on promoting the region’s financial services offering and continuing to expose the region’s Fintech talent and potential future talent coming through the education system in Manchester.

Fintech and social media

We can’t mention media without discussing social media. Greater Manchester had the second largest quantity of Fintech-related social media posts over the last 12 months. These posts are usually correlated with Fintech events showing the industry is coming together and valuing these interactions – therefore, we’d recommend any Fintech-related organisation going forward utilises these events to get their name out there and harness the power of social media to promote its message far and wide.

As you can see, our Fintech sector is only set to grow as time goes on but, only if we put things in place to support it.

If you’re looking to discuss the Fintech report in further detail or want help with your PR in this growing sector, drop us a line.